Welcome to our 🌐 Breaking Down Circular References in Project Finance Model Series!

📊 In this series, I'll guide you through the best practices of handling circular references in project finance models.

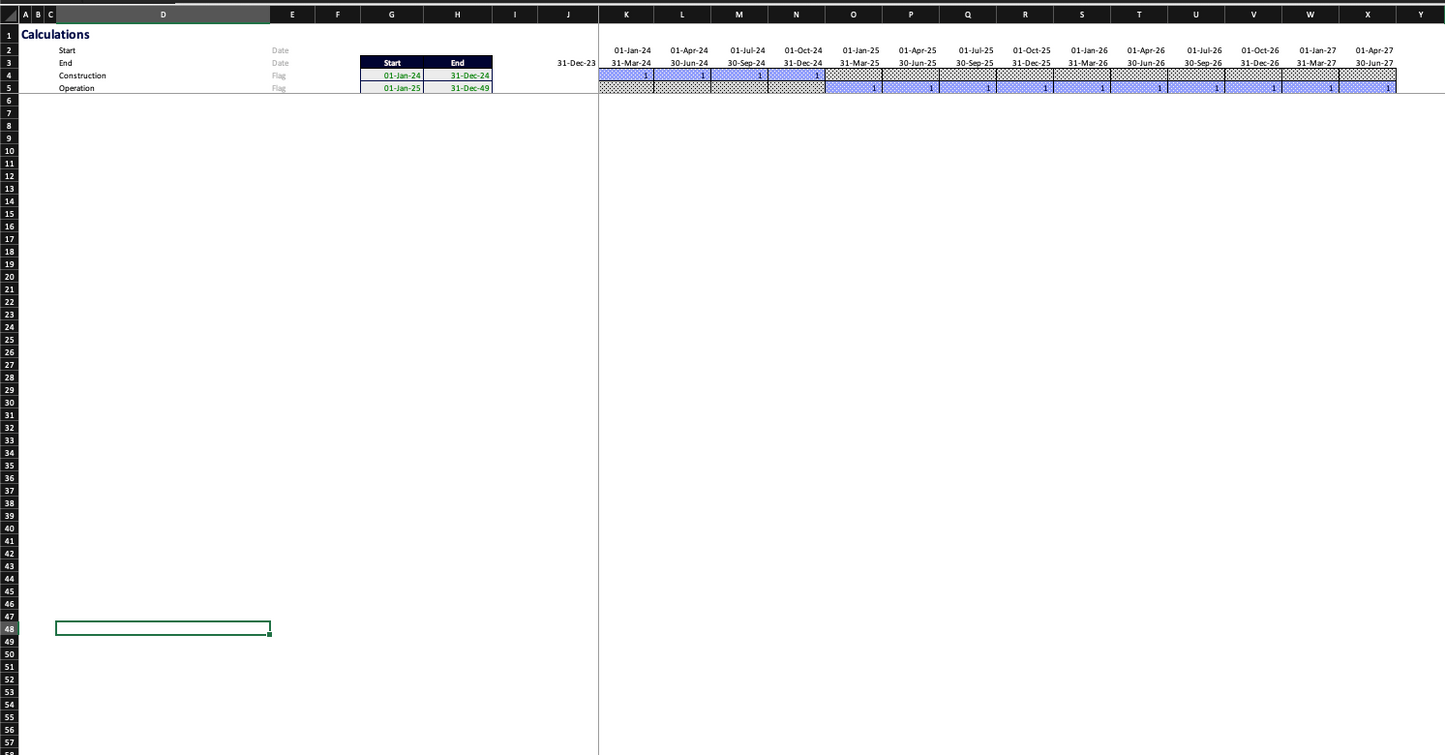

🔄 🏗️ Dive deep into the three core project finance structures that lead to circularities:

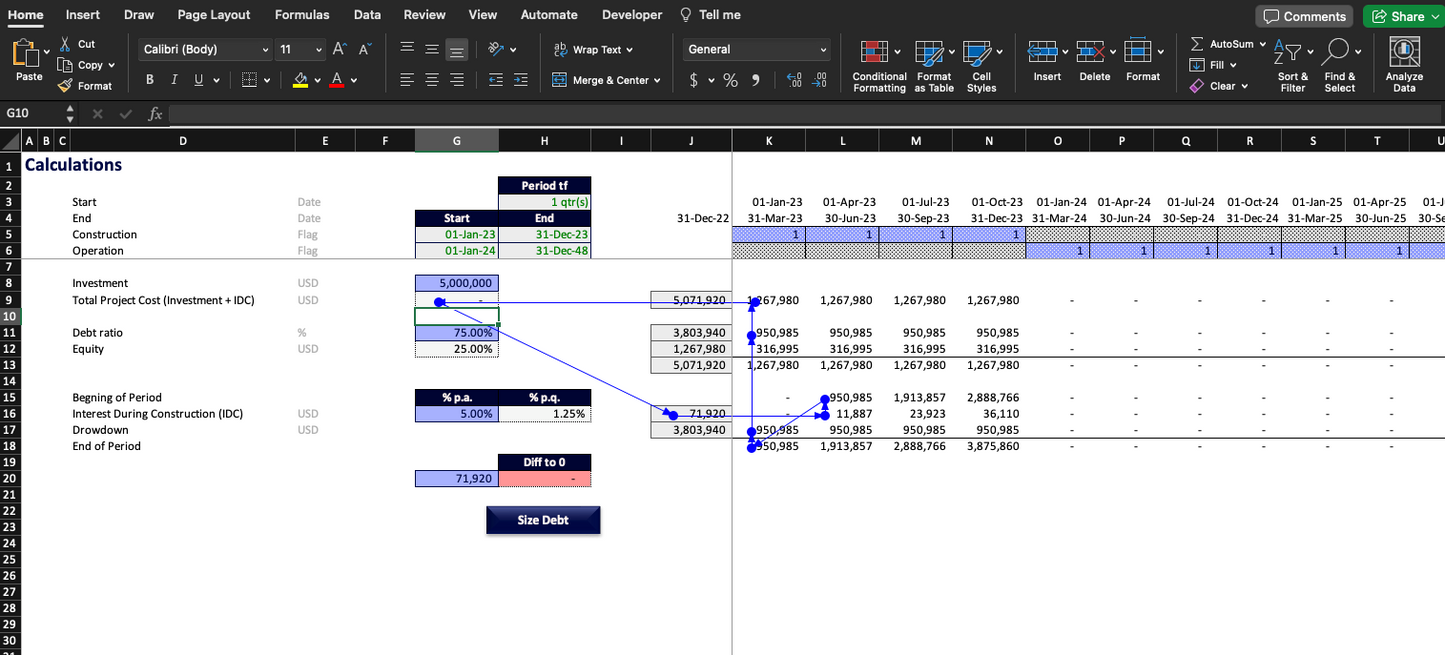

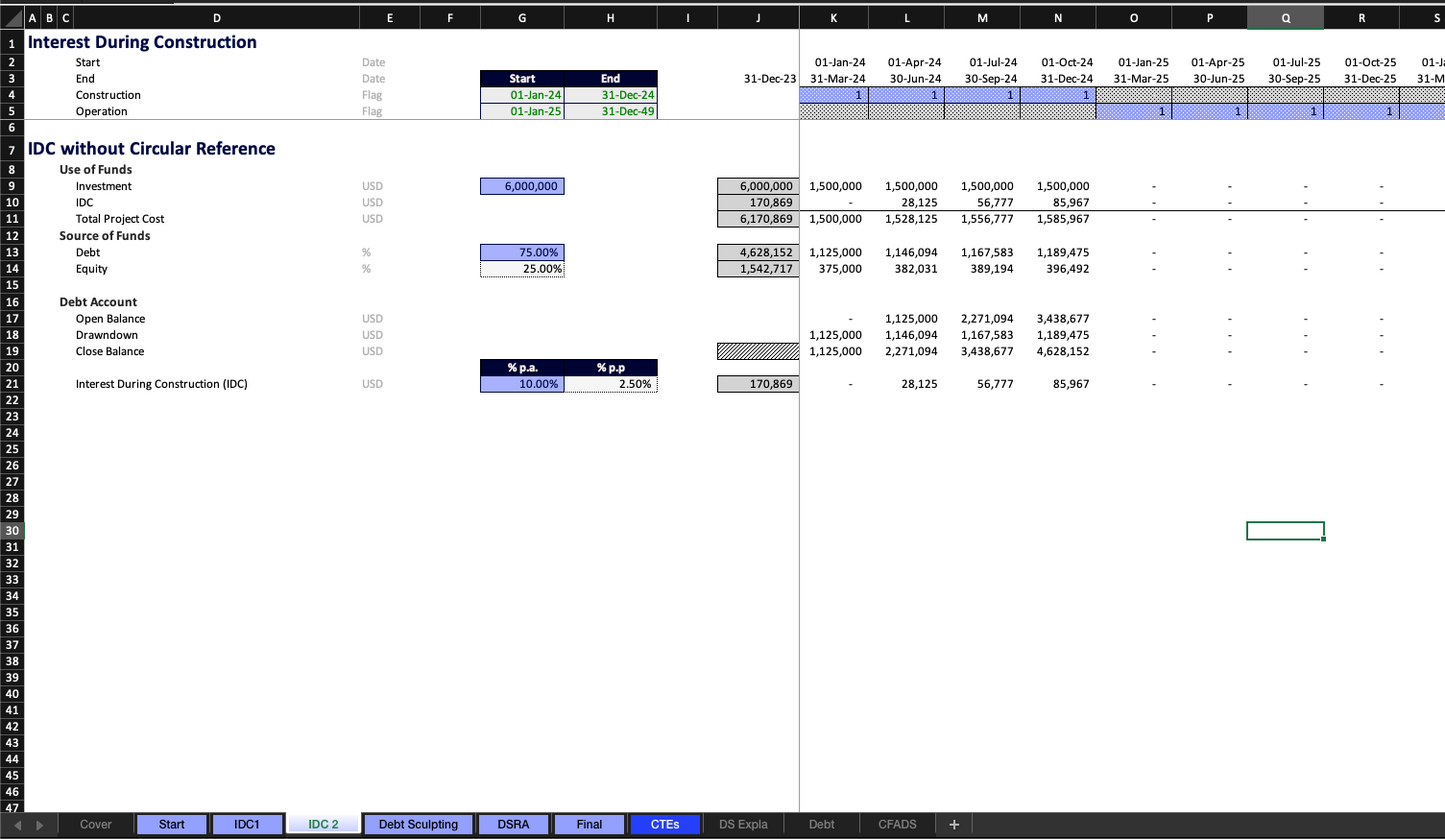

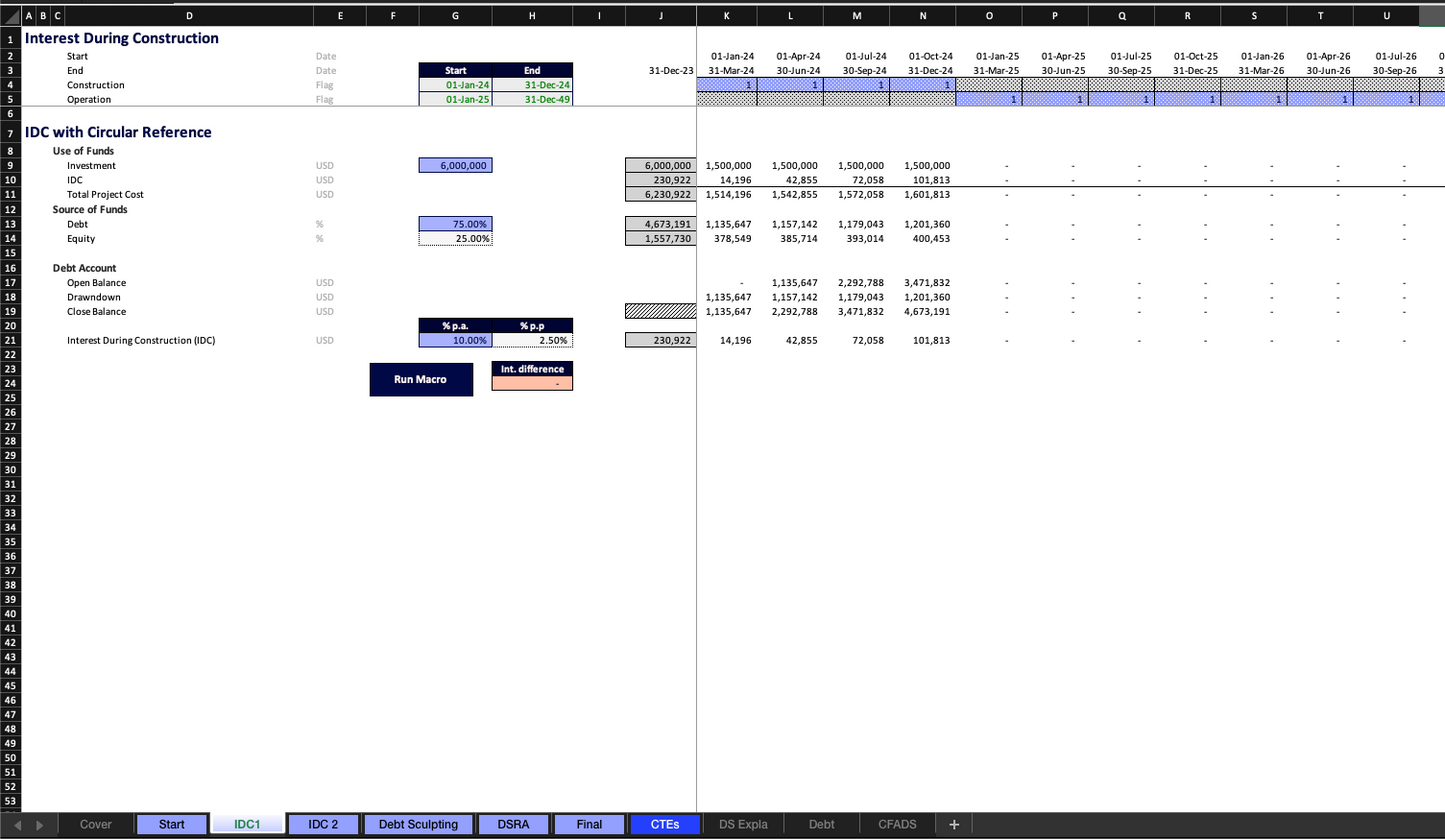

- Interest During Construction,

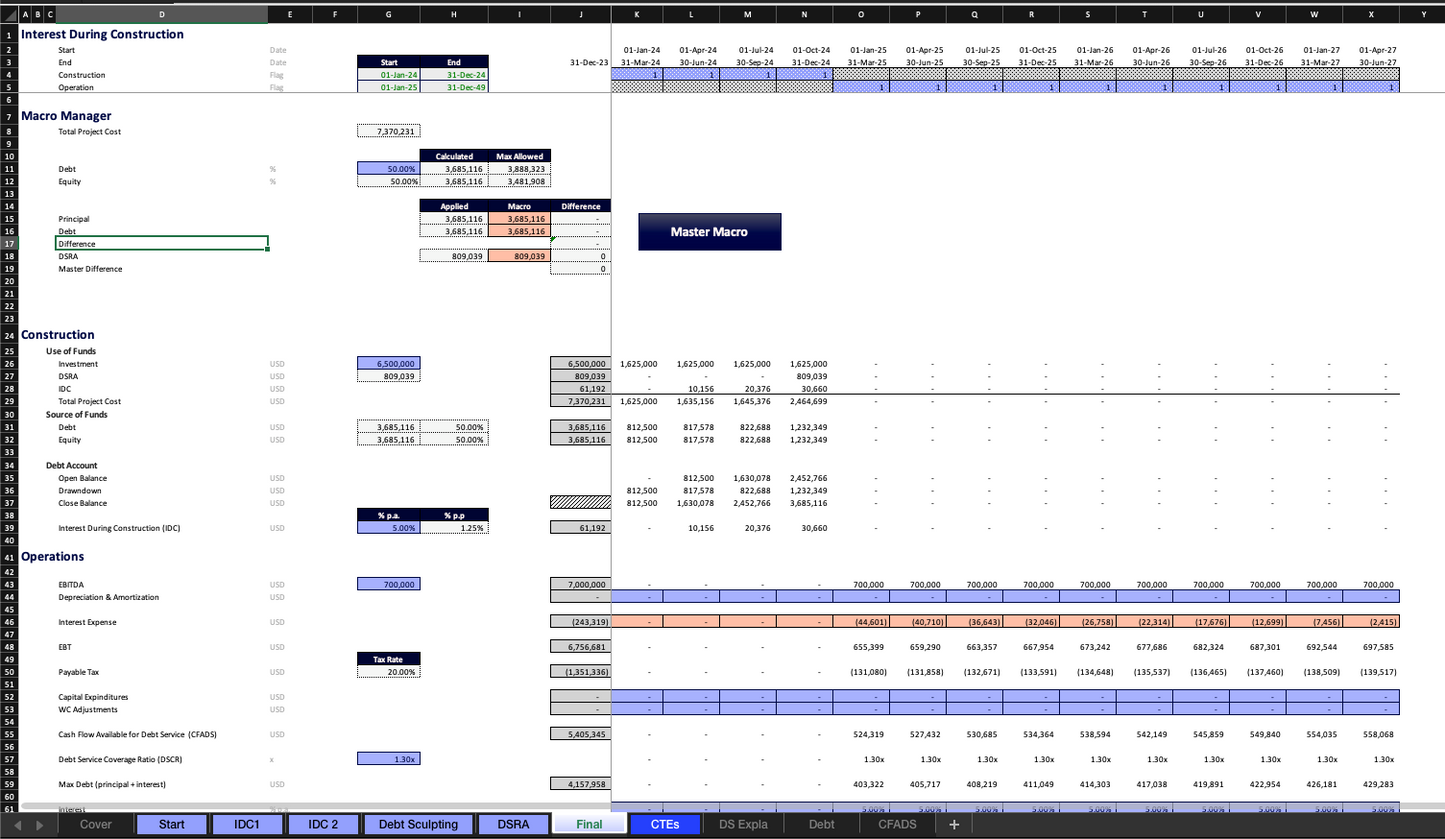

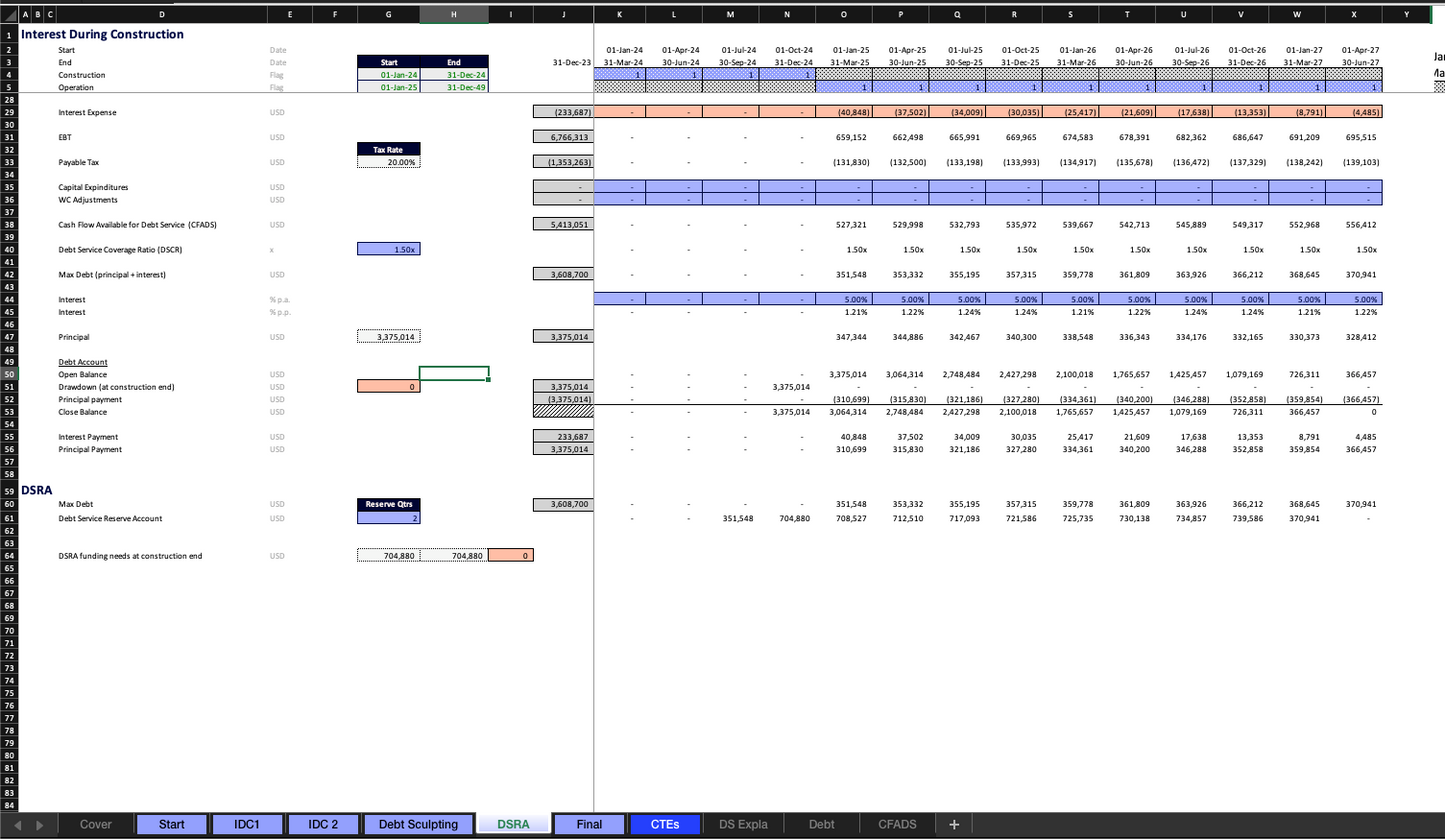

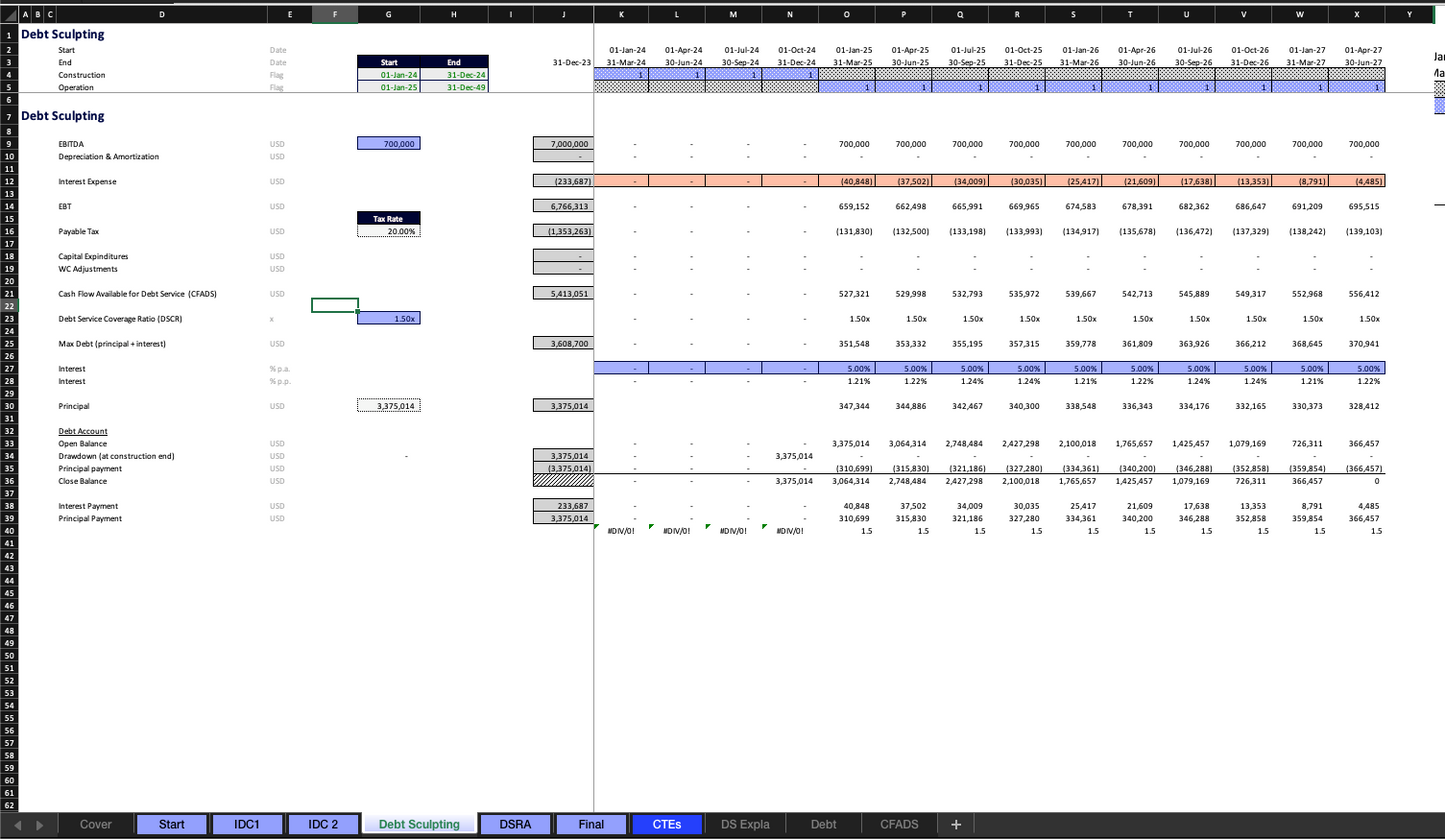

- Debt Sculpting, and

- Debt Service Reserve Account

- Commitment Fee

💡Learn their use and setup, and the root cause that generates circular references in each one of these structures.

💡 Discover how to seamlessly merge the circular reference from each structure into one master macro.

🧩 If you've ever felt lost in the complexity of financial modeling or struggled with circular references, this series is tailor-made for you.

🚀 📥 Download the free financial model for hands-on learning or support the channel by opting for the premium option, including 8 Excel files with start and end versions for each video.

If you haven't watched the video, just click here.