This versatile and simple financial model offers a straightforward approach to assess the returns of renewable energy projects. It includes cash flow analysis calculations and a user-friendly dashboard to present the results. With this model, you can determine the project's:

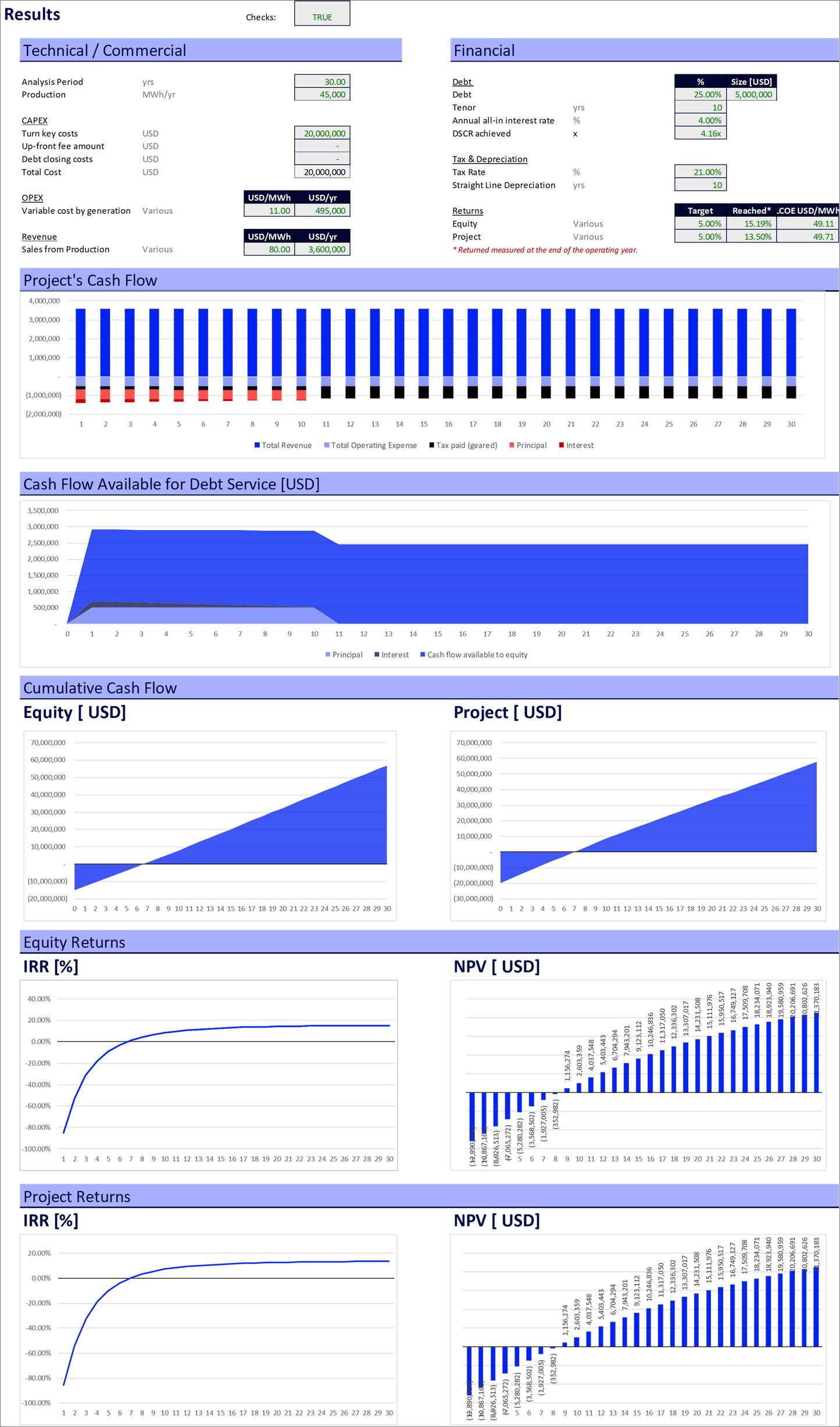

- Internal Rate of Return (IRR)

- Net Present Value (NPV)

- Levelized Cost of Electricity (LCoE) at both the project level (without debt) and for equity investors (with debt)

- Levelized Power Purchase Agreement (LPPA)

Several graphs are included to help interpret the results and visualize the cash flows through the project's lifetime.

This financial model is designed for individuals who want a straightforward and user-friendly approach to analyzing renewable energy projects. It eliminates the need for in-depth financial analysis knowledge, saving you from spending hours deciphering complex background calculations. This is the simplest model available, encompassing all the essential tools and results found in comprehensive financial models.

Main Features:

- Simple to use and fast to run

- No Macros or circularities to deal with

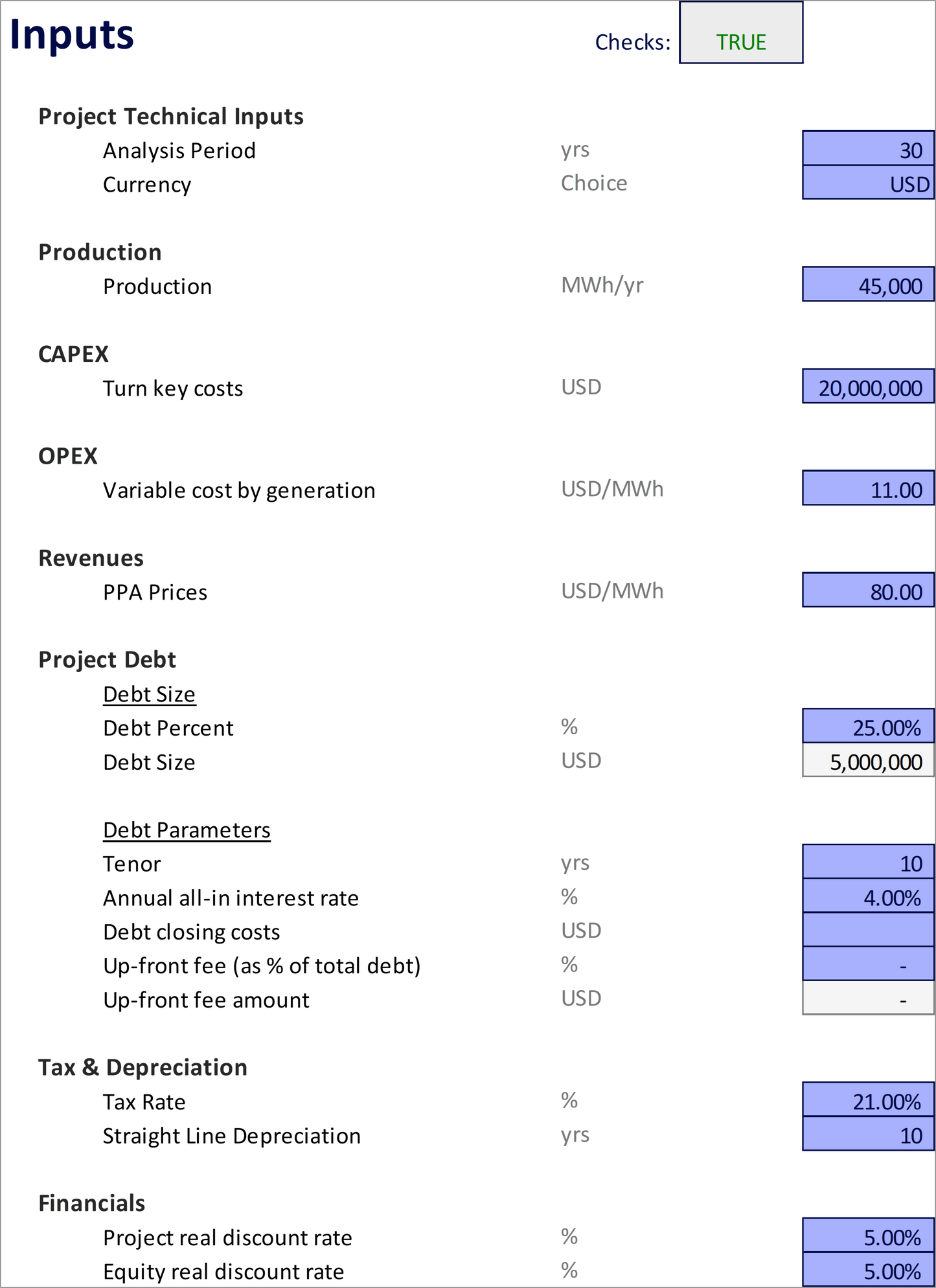

- Only 15 inputs required to get started (with the fixed timeline)

- Cover page and documentation section explaining how to use the model and how the calculations are performed

- Comprehensive dashboard with charts and reports

Financial Model Structure:

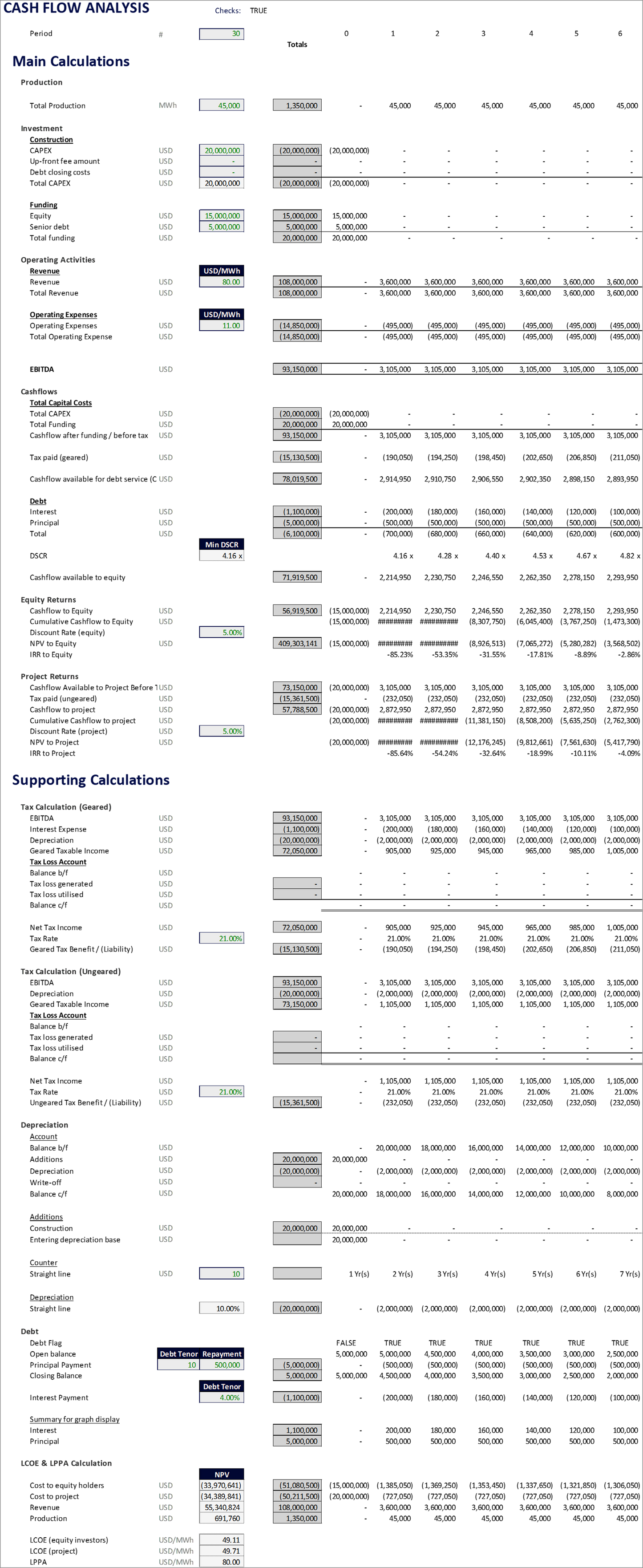

The model is divided into the following sheets:

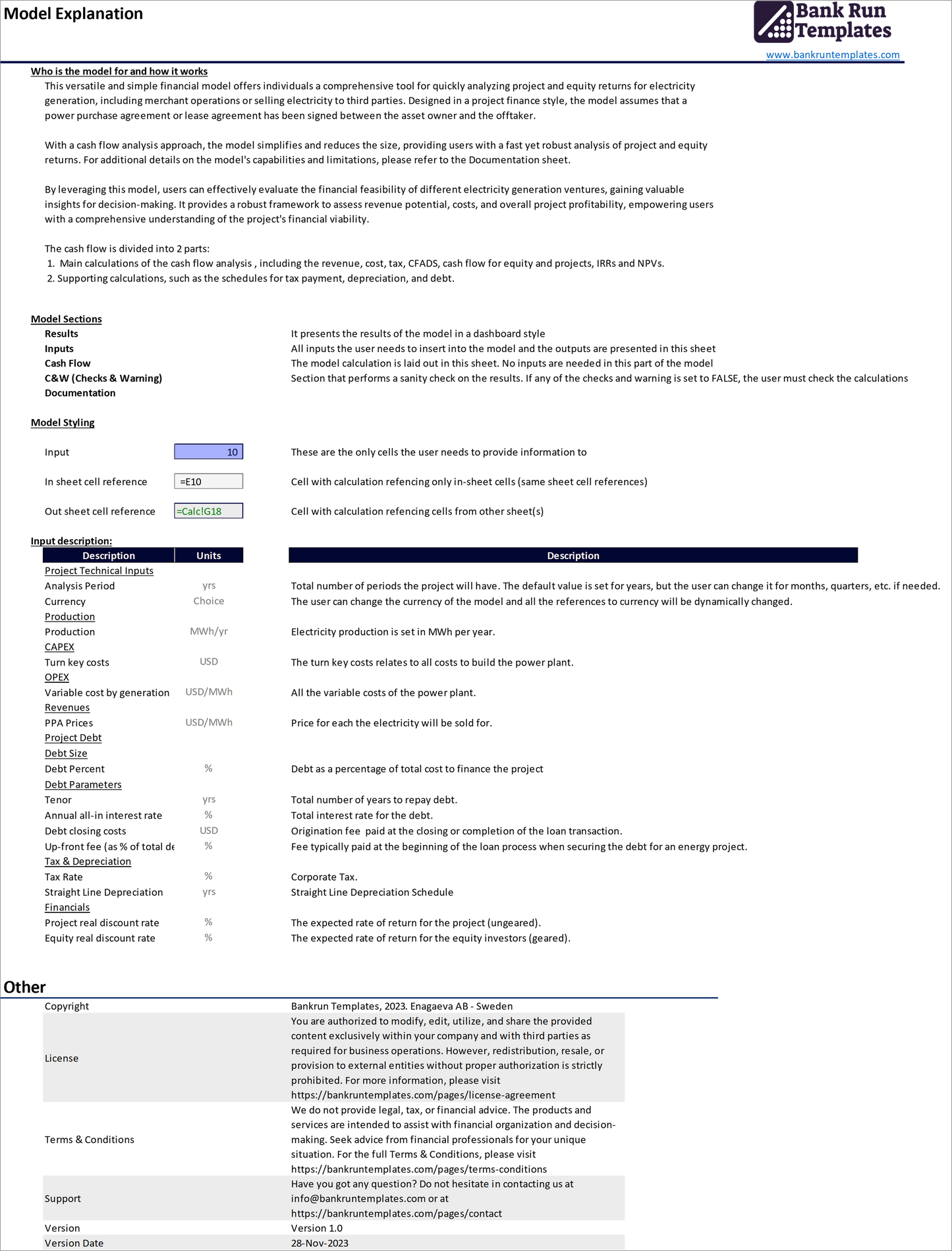

- Cover: Provides the description and instructions on how to operate the model, the style used, and a description of all inputs the user should set to run the financial model.

- Results: Dashboard displaying the main inputs and outputs, including 8 graphs showcasing the cash flows and project returns.

- Inputs: The only sheet requiring user input; used to set the variables that will power the calculations.

- Cash Flow: Where the financial model calculations are performed.

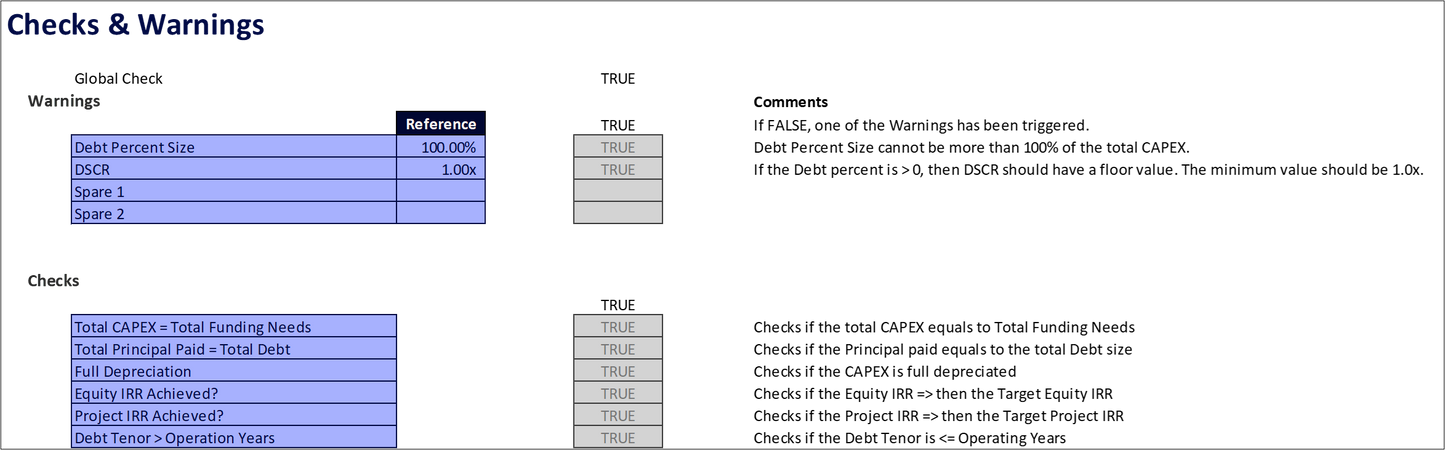

- C&W (Checks & Warnings): Performs sanity checks on the model.

- Documentation: Explains assumptions and key formulas used in the model.

Key Calculations:

- Production / Electricity Generation

- Investment (CAPEX + Funding)

- Operating Activities (OPEX)

- Cash Flow Available to Debt Service (CFADS)

- Equity Return

- Project Return

- Levelized Cost of Electricity (LCoE) & Power Purchase Agreement (LPPA)

What's in the Dynamic Timeline Version?

We are excited to introduce the new Dynamic timeline or FlexiDates model. This upgraded version builds on the original template by adding the ability to customize the timeframes for each phase of your renewable energy project. Unlike the original model, which only allows for fixed yearly periods to calculate the overnight returns of your project, this new version lets you set different durations for each project phase. For example, during the construction phase, you can define a 1-month period for each cashflow column, while the operations phase can have 1-year periods. This flexibility makes it easier to reflect the true cash flow patterns of your project, providing more accurate financial analysis.

How Do the Two Versions Differ?

Original Version (FM Cashflow Analysis): The original model is based on fixed yearly periods, with each column representing a full year. It’s ideal for projects where the timeline is straightforward and the cash flows can be assumed to follow an annual pattern.

New Version (FM Cashflow Analysis FlexiDates): The new version introduces greater flexibility by allowing you to set custom timeframes for each project phase. Whether it’s a few months for the construction phase or multiple years for the operations phase, you can now define the duration of each column in your cash flow analysis. This flexibility is perfect for complex projects where different phases require varying timelines.

Special Offer: Buy Both Models for a Discount!

Get both the original and the new version at a discounted price! This offer lets you choose between a simple fixed-year model or a more flexible, customizable model based on your project needs. Purchase both versions today and save money while gaining access to both financial models to suit any type of renewable energy project.