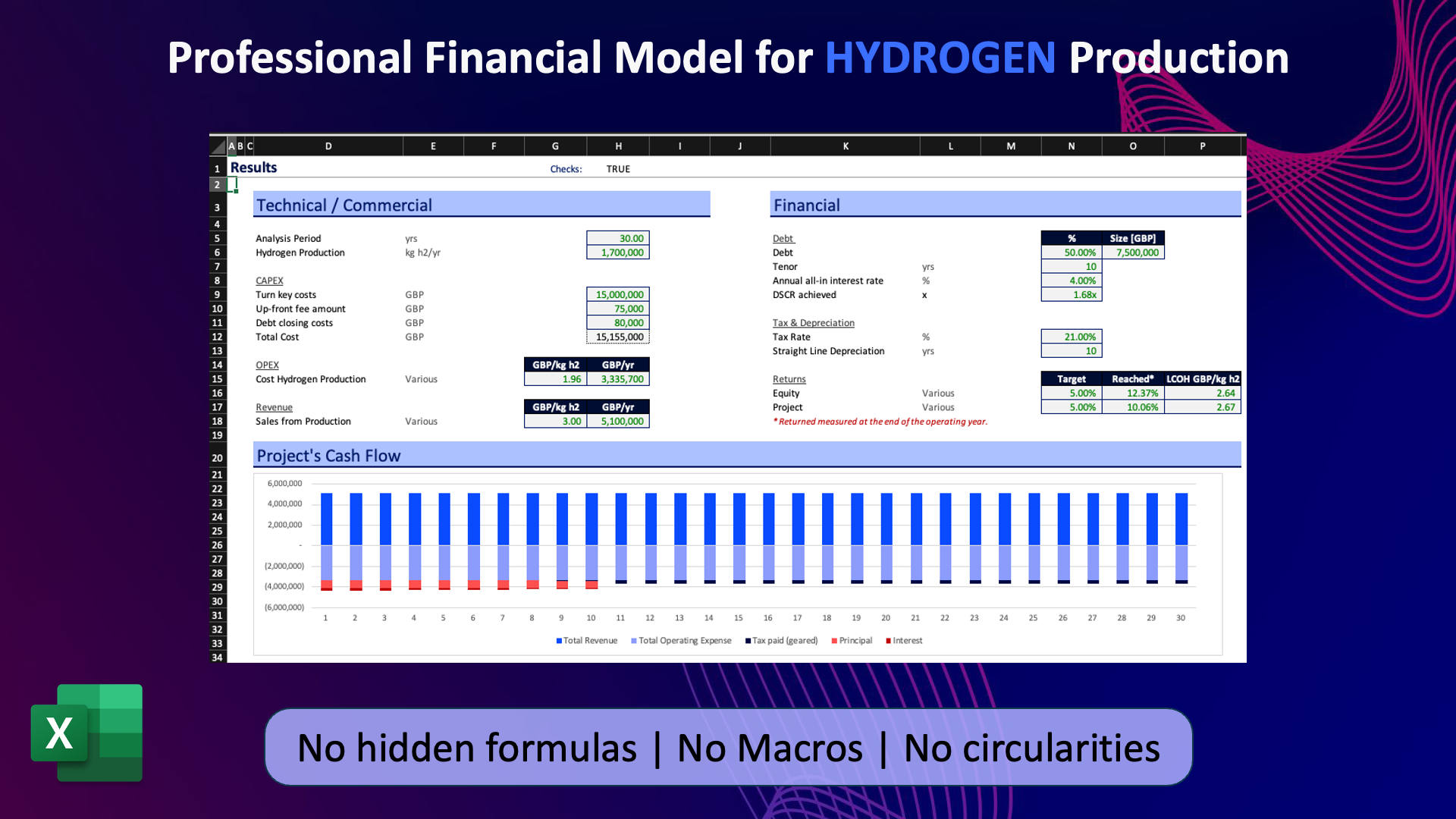

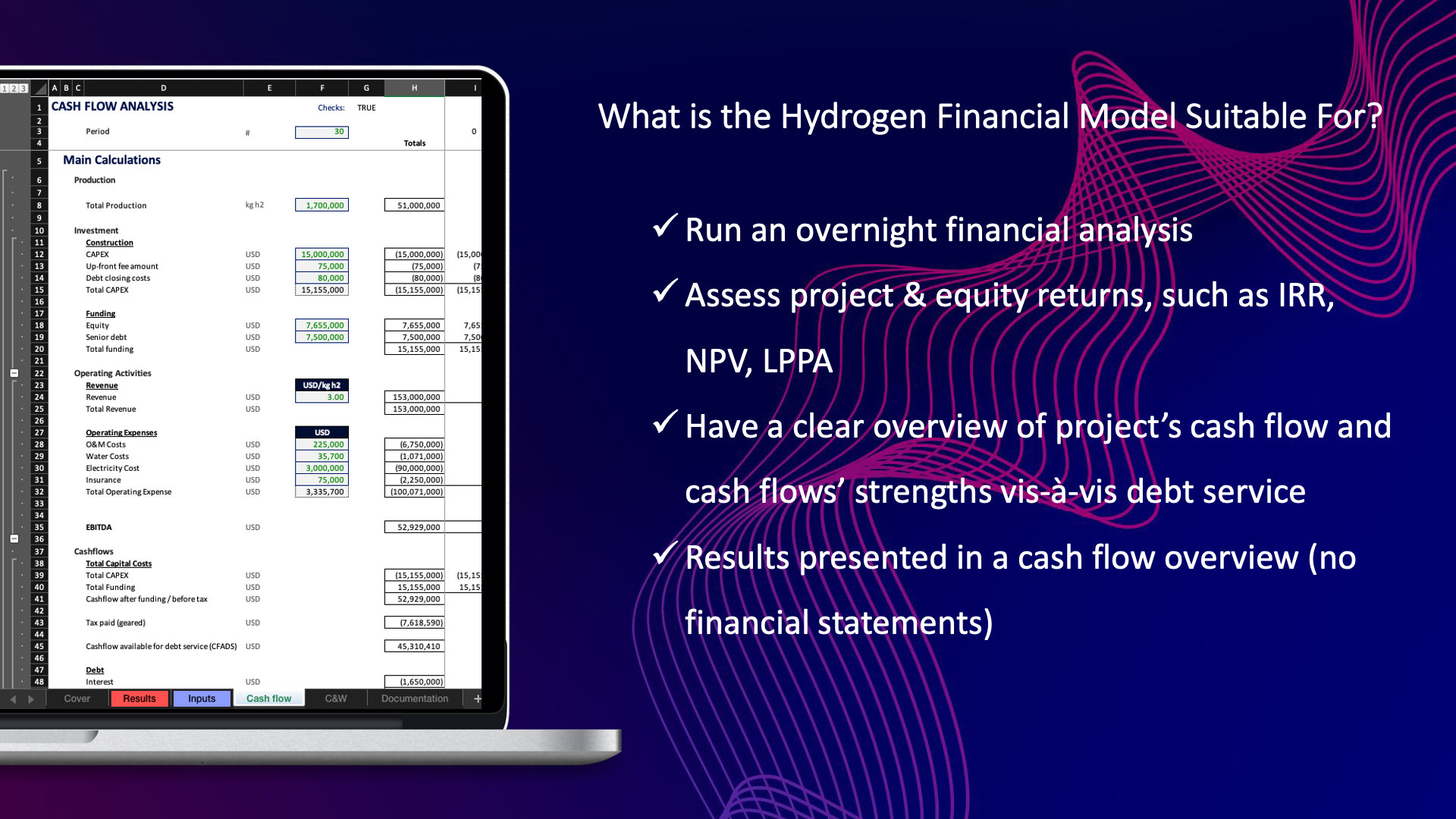

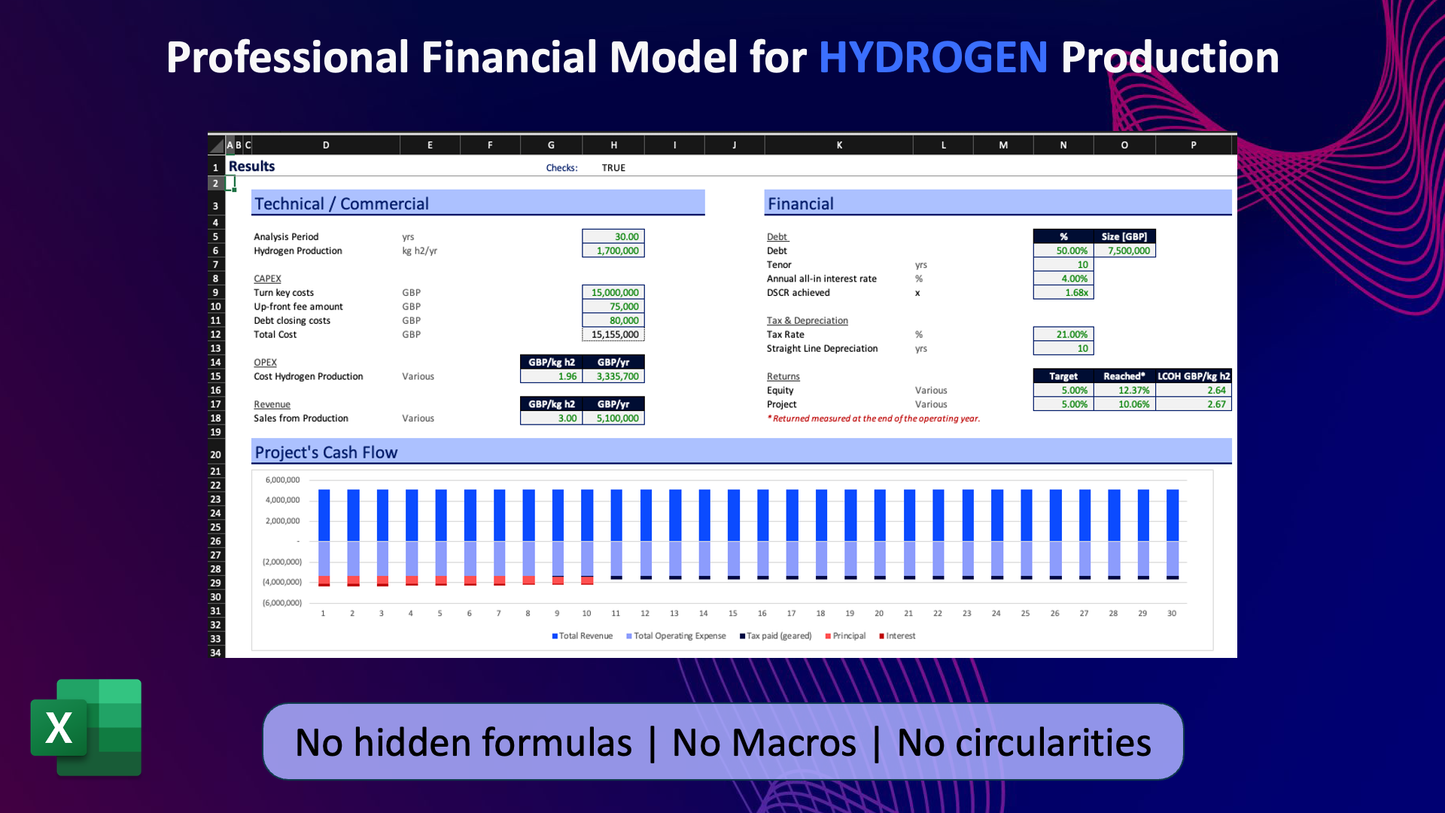

The financial model offers a straightforward approach to assess the overnight returns of hydrogen projects. It includes cash flow analysis calculations and a user-friendly dashboard to present the results. With this model, you can determine the project's :

- Internal Rate of Return (IRR),

- Net Present Value (NPV),

- Levelized Cost of Hydrogen (LCoH) at both the project level (without debt) and for equity investors (with debt),

- Levelized Power Purchase Agreement (LPPA).

You will see find several graphs to interpreter the results and see the cash flows through the project's lifetime.

This financial model is specifically designed for individuals who want a straightforward and user-friendly approach to analyze hydrogen projects. It eliminates the need for in-depth financial analysis knowledge and saves you from spending hours deciphering complex background calculations. This is the simplest model available, encompassing all the essential tools and results found in comprehensive financial models.

Main Features:

- Simple to use

- Fast to run

- No Macros or circularities to deal with

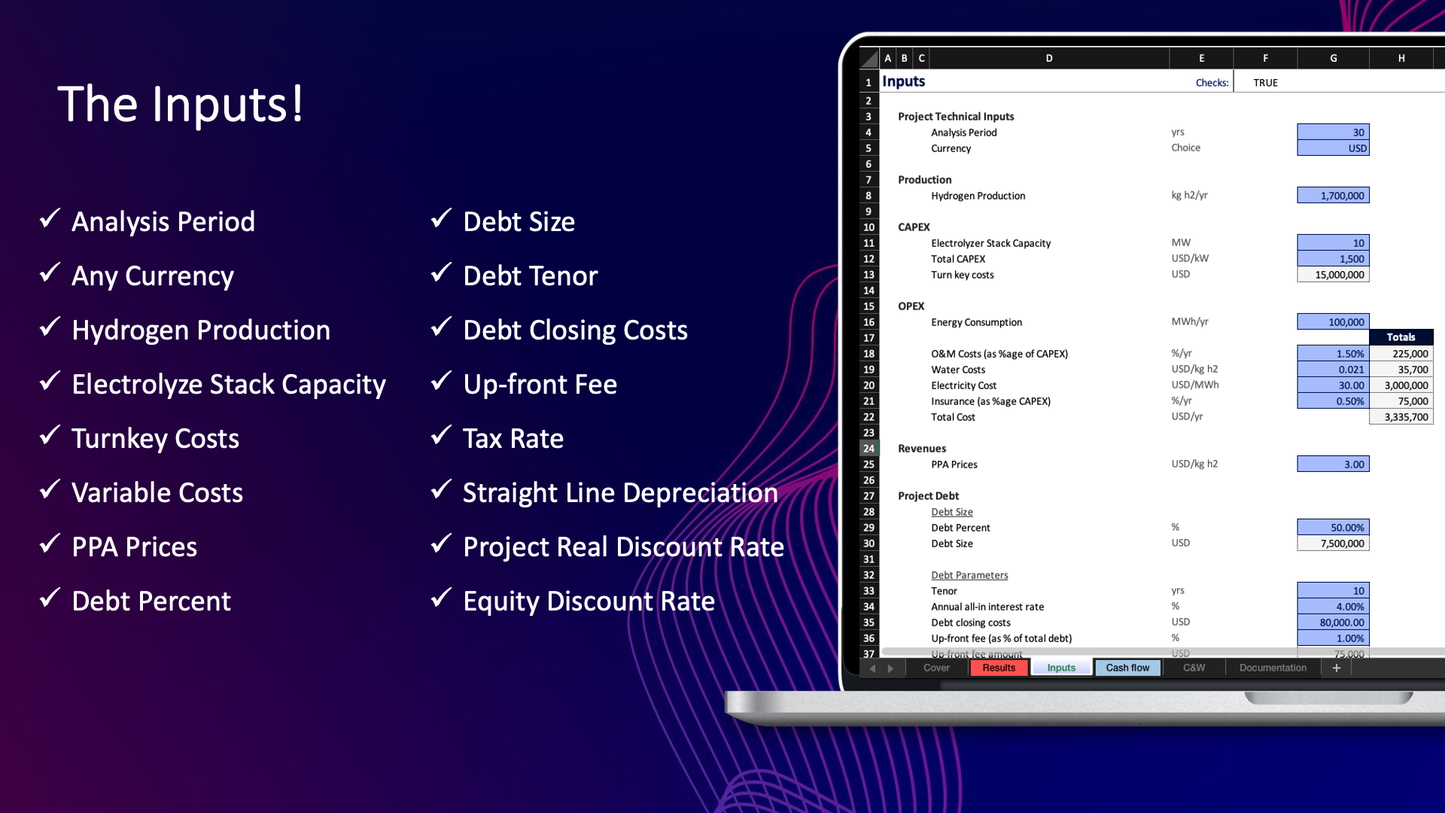

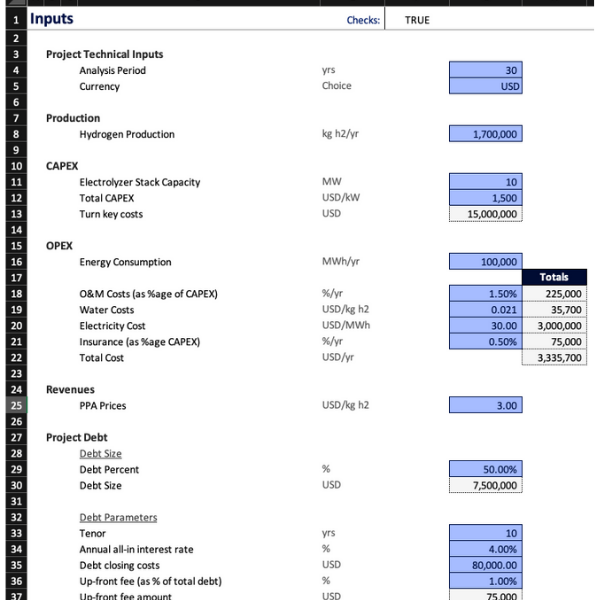

- Only 15 inputs

- Cover page and Documentation section explaining how to use the model and how the calculations are performed.

- Dashboard with charts and report

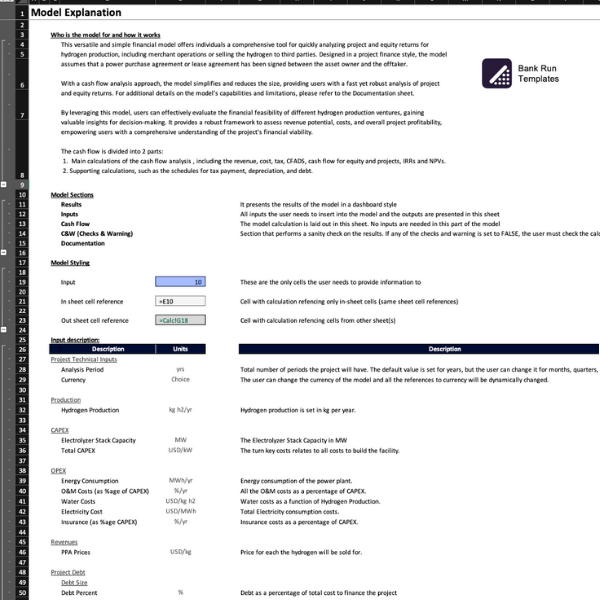

Financial Model Structure:

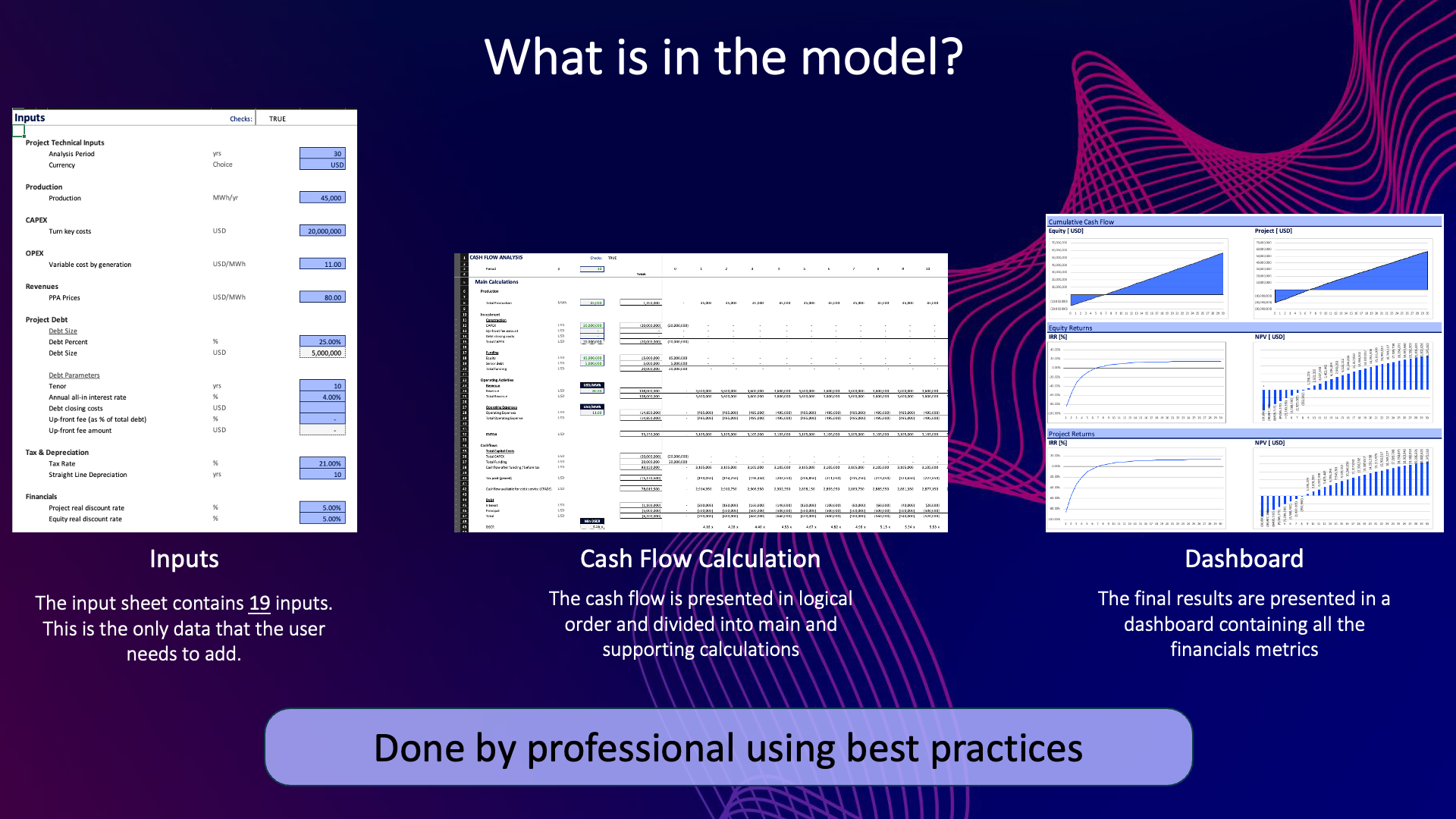

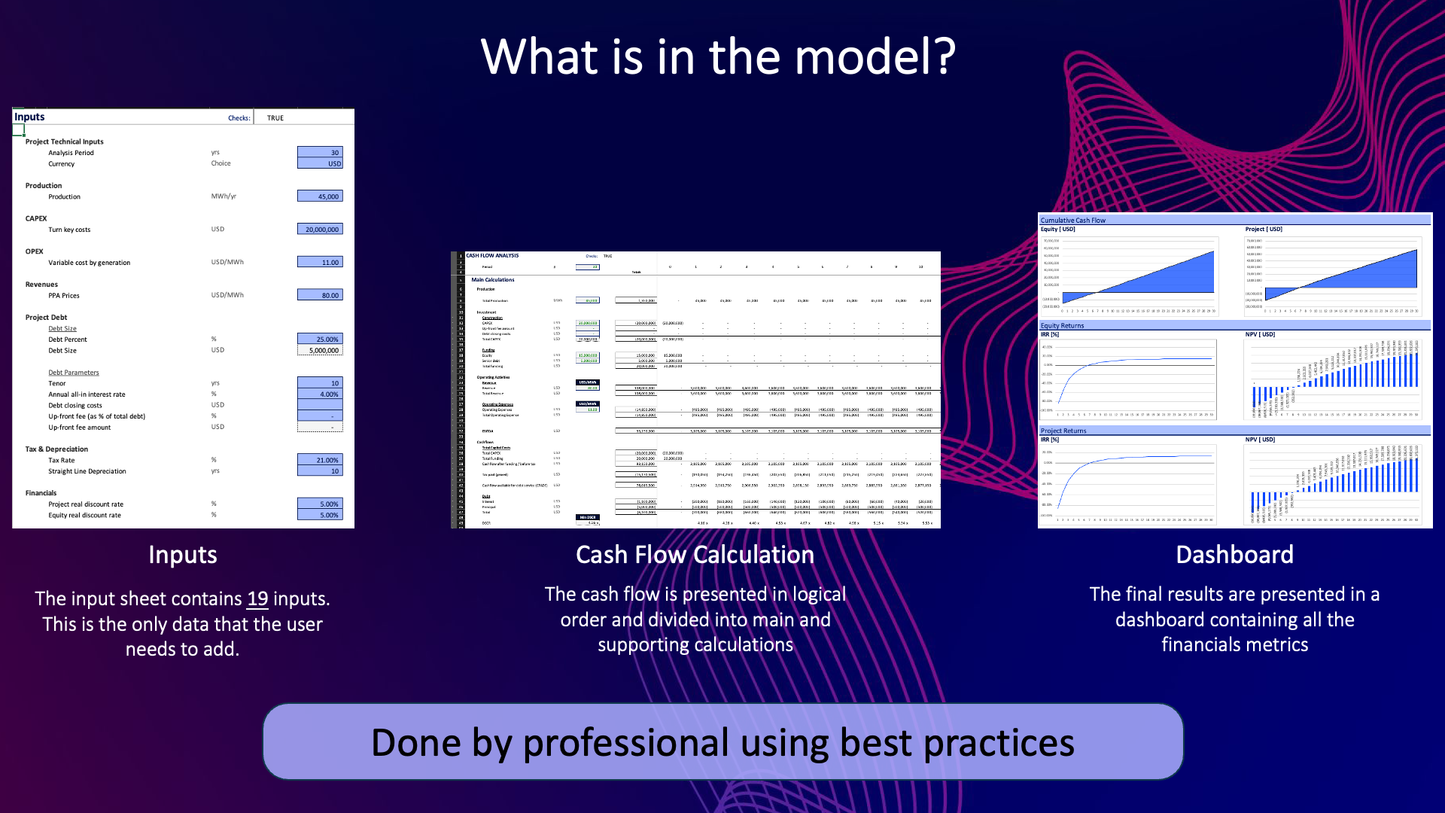

The model is divided into the following sheets:

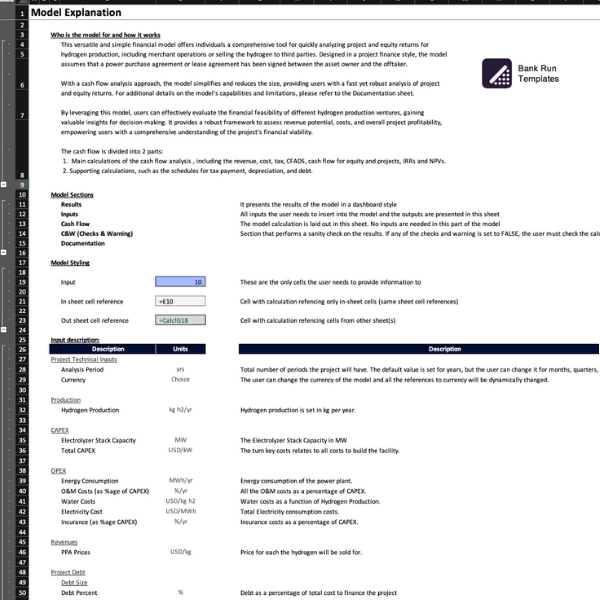

- Cover: presents the description of how to operate the model, the style used in the model and a descriptions of all inputs the user should set to run the financial model.

- Results: a dashboard with the main inputs and all of the outputs, including 8 graphs presenting the cash flows and returns of the project.

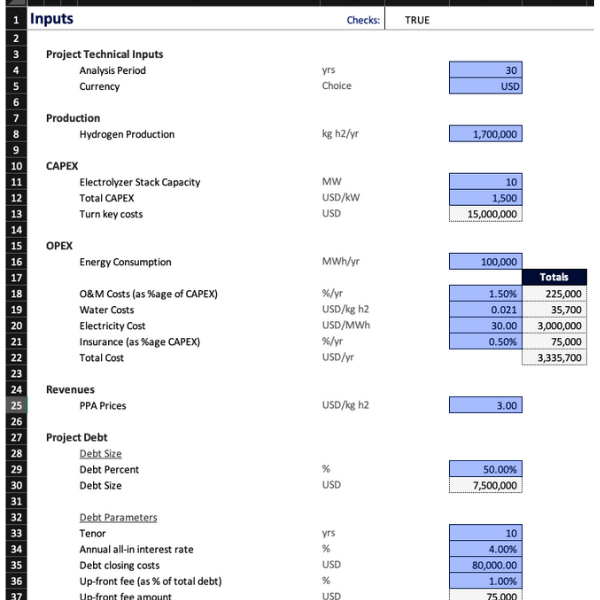

- Inputs: all the inputs the user needs to provide to run the model. This is the only sheet in the model that the user needs to provide information. All the other sheets are calculated and it is only used for the user to review and check results.

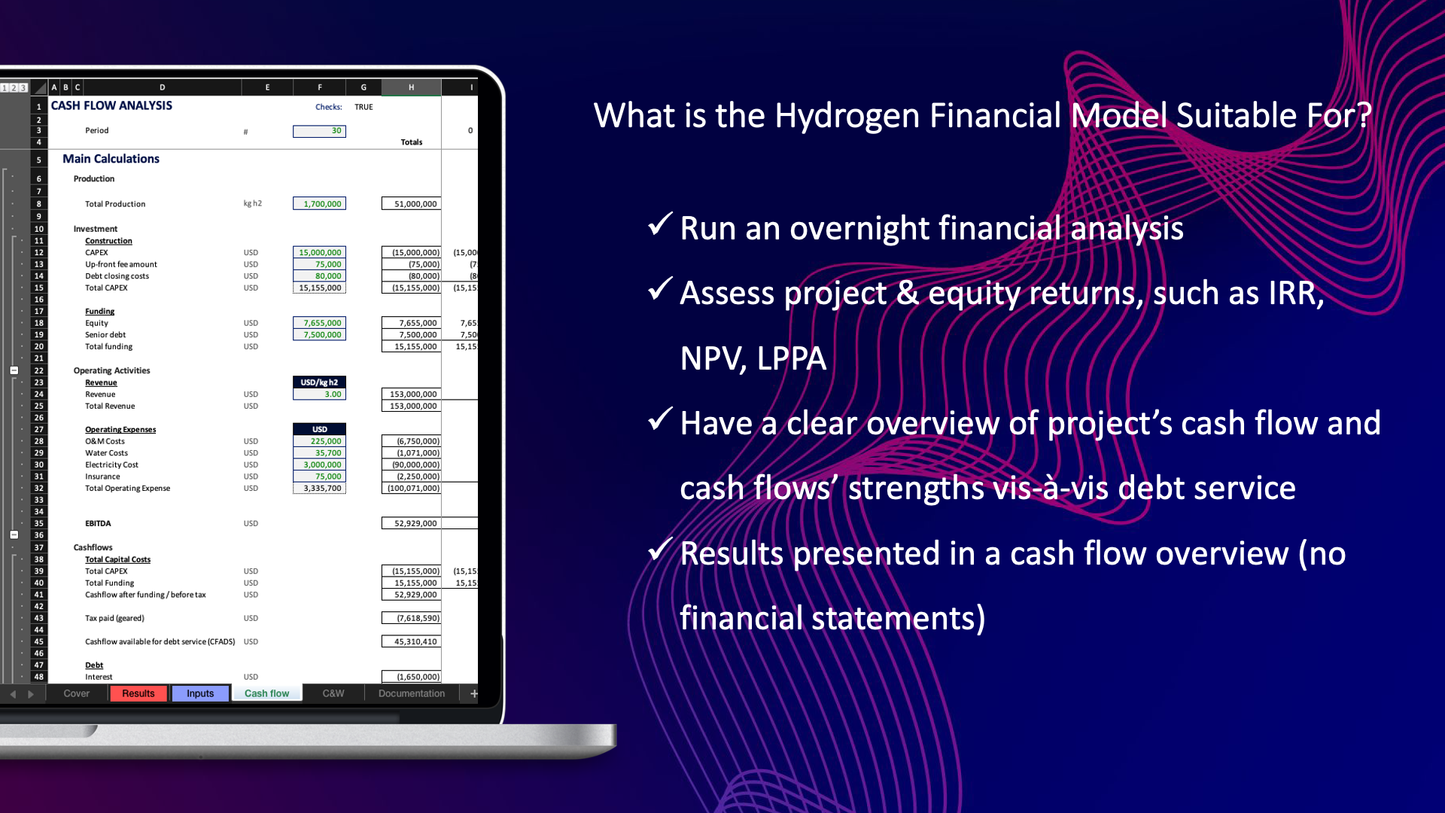

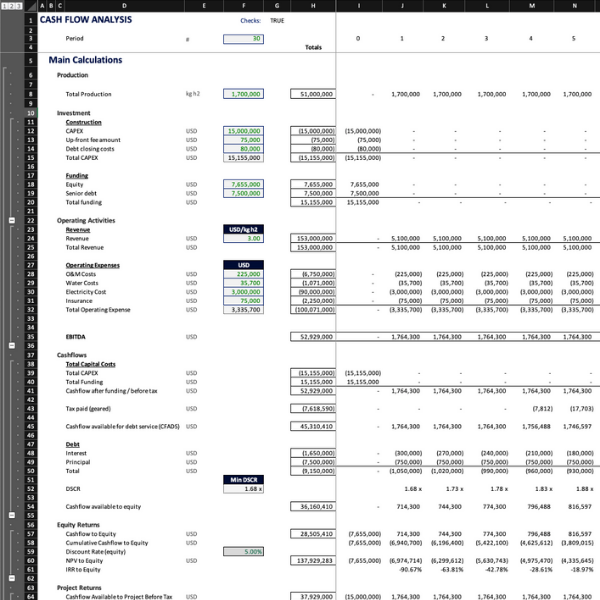

- Cash Flow: This is where the financial model calculations are performed.

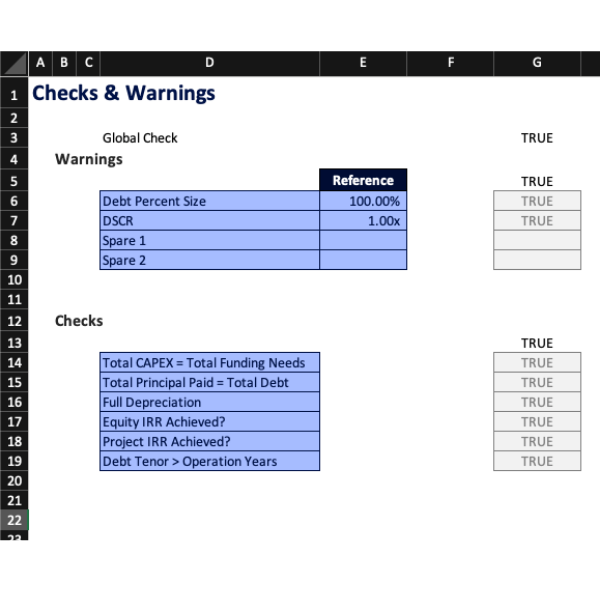

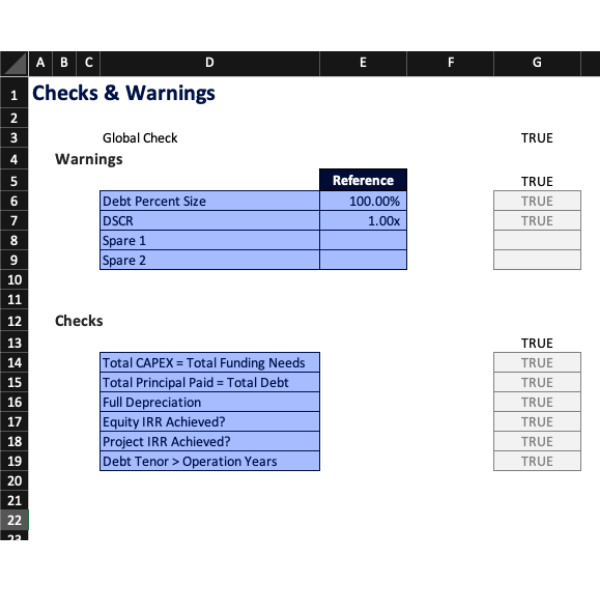

- C&W (Checks & Warnings): Sheet that performs model's sanity check.

- Documentation: this section provides information to the user about some of the assumptions used in the formulas and calculations and explanations on the main model's items.

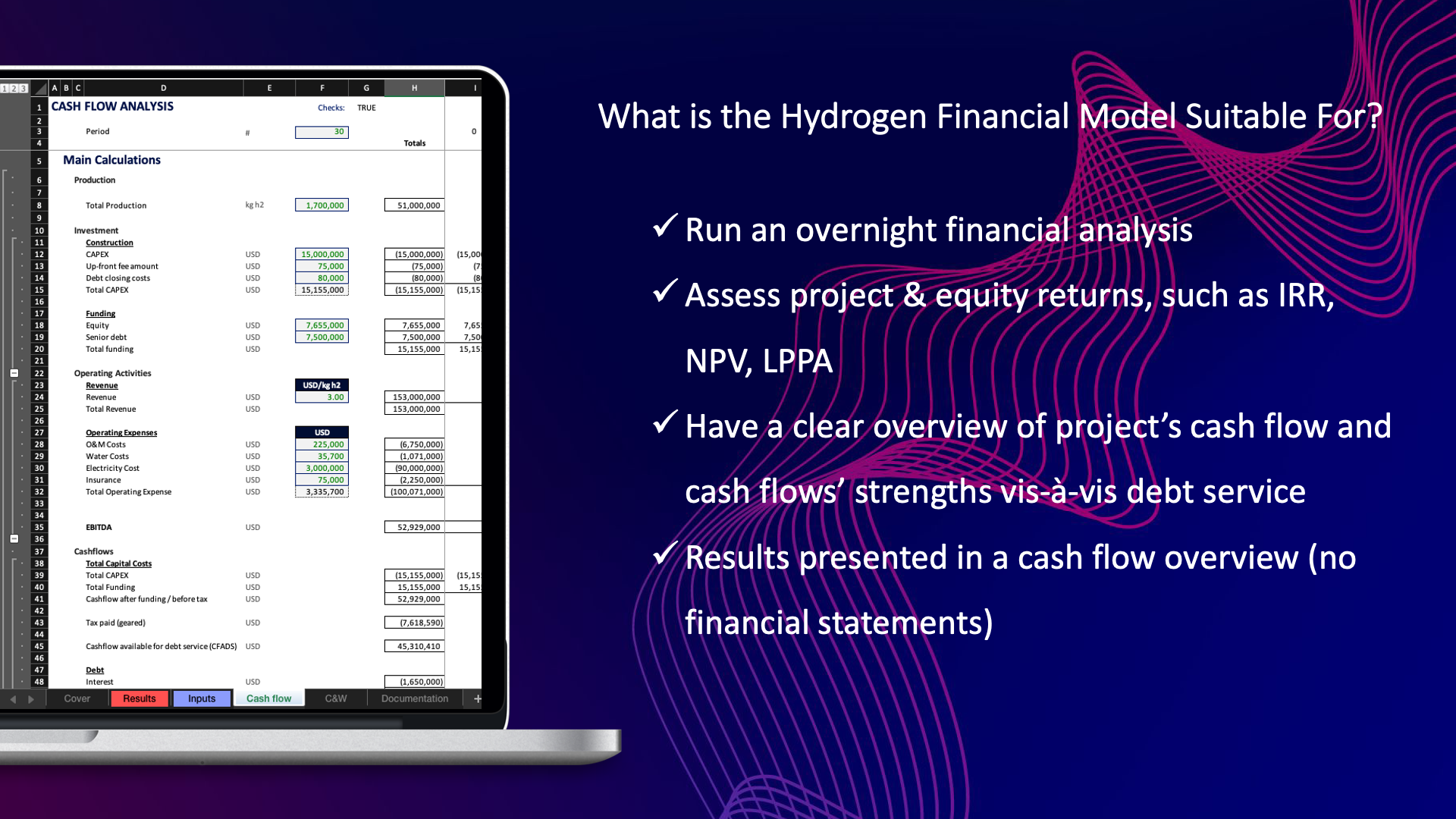

Cash Flow Structure:

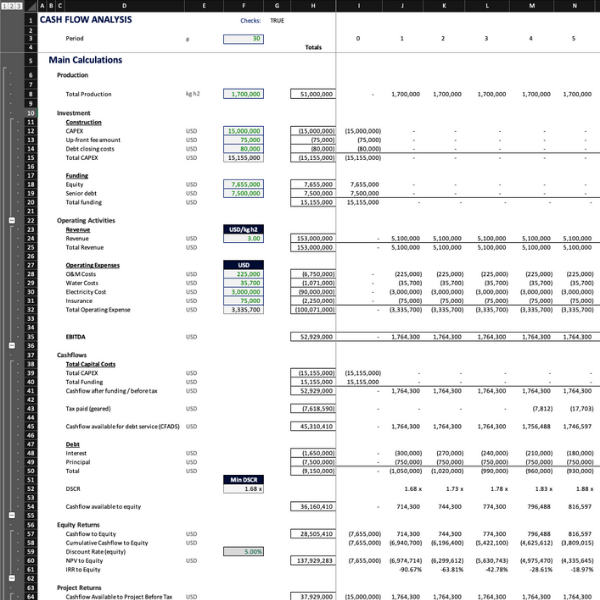

The Cash Flow is divided into 2 main sections:

A. Main Calculations:

- Production / electricity generation

- Investment (CAPEX + Funding)

- Operating Activities (OPEX)

- Cash Flow Available to Debt Service (CFADS)

- Cash Flow Available to Equity

- Equity Return

- Project Return

B. Supporting Calculations:

- Tax Calculations (geared & ungeared)

- Depreciation schedule and calculation

- Debt

- LCOE & LPPA calculations